FLEX LNG: A Comprehensive Analysis

FLEX LNG Ltd., a leading liquefied natural gas (LNG) carrier company, offers a unique investment opportunity with its high dividend yield and stable financial performance. The company has a fleet of 13 modern LNG carriers with an average age of 4.8 years, and it benefits from long-term fixed-hire charters that provide cash flow stability and earnings visibility.

Key Highlights

- High Dividend Yield: FLNG's forward dividend yield sits at a substantial 12%, significantly exceeding the industry average. The company has consistently paid quarterly dividends of $0.75 per share since Q4 2021.

- Stable Cash Flows: The company's long-term charters ensure stable cash flows even during market volatility, with a significant contract backlog.

- Financial Performance: Despite seasonal declines and higher operating expenses, FLNG maintains a strong balance sheet and attractive dividends, with revenues expected to rise in Q3 and Q4 due to improving market conditions and seasonal demand. There are no debt maturities before 2028, with maturities stretching to 2034. Additionally, a cash position of $467m as per Q2-24

- Market Expectations: The company expects to benefit from rising spot market rates in the colder months, further boosting revenues and profits.

Quarterly Performance

In Q2 2024, FLNG reported revenues of $84.7 million, in line with guidance but reflecting seasonal softness. The company reported a net income of $21.8 million or $0.41 per share adjusted net income of $30.4 million or $0.56 per share.

The outlook for Q3 and Q4 looks promising. Revenues are expected to rise to $90 million in Q3, driven by the return of all ships to the entire operation and improving market conditions. Historically, Q4 is FLNG’s strongest quarter due to increased seasonal demand for LNG.

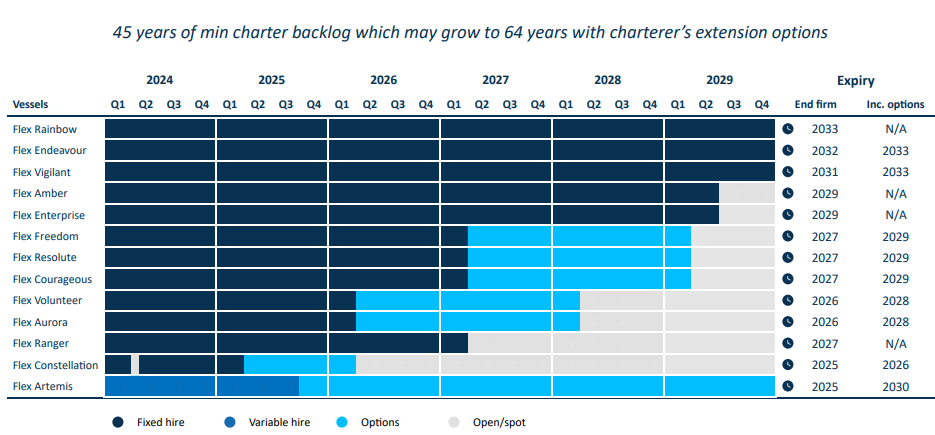

Charter Backlog and Strategic Management

FLNG has a massive 45-year charter backlog, which could potentially grow to 64 years through extension options. This provides unparalleled earnings visibility and supports the 11.9% yield, making FLNG a bond-like investment. The company's strategic fleet management and long-term contracts position it well for consistent cash flow, even in volatile markets.

The shipping industry’s volatility, influenced by political events and currency risks, is mitigated by FLNG's use of derivatives to hedge risks. The company’s adjusted EPS, while not fully covering the $0.75 dividend in Q1-2 '24, shows strong dividend coverage when non-cash depreciation is considered.

Valuation

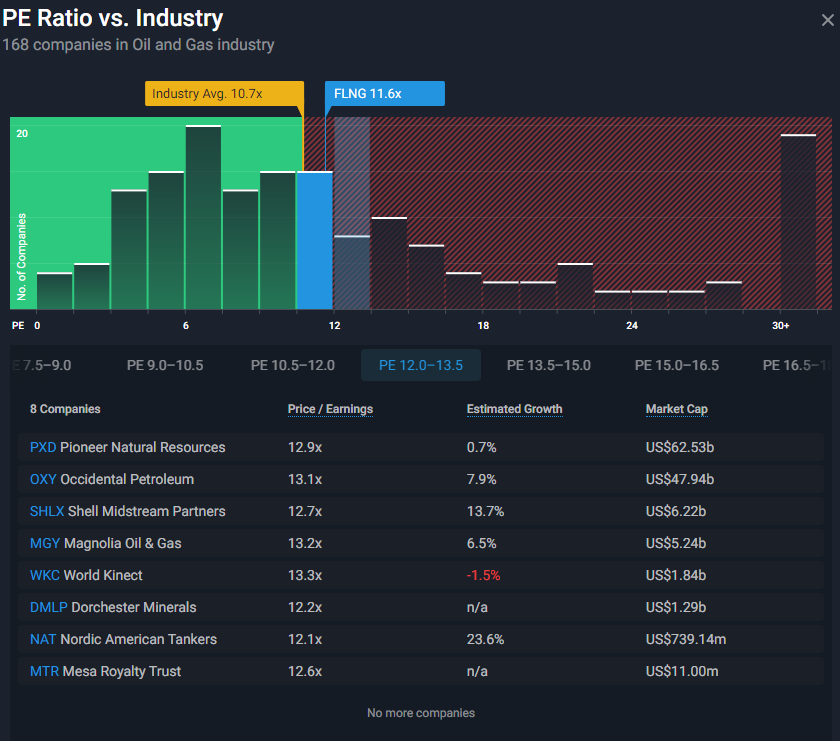

FLNG trades at a slight premium valuation compared to its industry peers, with higher P/E ratios. Essentially, the FLNG business model is like an O&G midstream pipeline – providing a service to transport energy for a contracted fee.

Catalyst - Potential interest rate cut

FLNG's current dividend yield of approximately 12% stands out in the market. In a low-interest-rate environment, this high yield could become even more appealing to income-focused investors, potentially driving demand for FLNG shares.

A decrease in interest rates could also substantially improve FLNG's financial position. Lower borrowing costs may lead to reduced expenses on variable-rate debt, opportunities for advantageous debt refinancing and improved cash flow, potentially supporting capital expenditures or shareholder returns.

Conclusion

Buying FLEX LNG ahead of potential rate cuts could be a smart move. Historically, high-yield equities like FLNG attract investors during rate cuts, potentially driving up demand and prices. With its tremendous yield and exceptional cash flow visibility, FLNG is a strong candidate as a fixed-income investment alternative.

In conclusion, FLEX LNG presents a compelling investment case for income investors seeking high and stable dividends backed by the company's long-term charters and robust financial health.

Details

FLEX LNG: LNG Shipping Idea For Income-Minded Investors; Rating Unchanged

FLEX LNG Ltd., a leading liquefied natural gas (LNG) carrier company, offers a unique investment opportunity with its high dividend yield and stable financial performance. The company has a fleet of 13 modern LNG carriers with an average age of 4.8 years, and it benefits from long-term fixed-hire charters that provide cash flow stability and earnings visibility.

Key highlights include:

- High Dividend Yield: FLNG offers a 12% dividend yield, making it an attractive option for income-minded investors.

- Stable Cash Flows: The company's long-term charters ensure stable cash flows even during market volatility, with a significant contract backlog.

- Financial Performance: Despite a decline in net income in Q2 2024 due to seasonality and higher operating expenses, FLNG maintains a strong balance sheet and attractive dividends.

- Valuation: FLNG trades at a premium valuation compared to its industry peers, with a higher trailing P/E, forward P/E, and EV/EBITDA.

- Market Expectations: The company expects to benefit from rising spot market rates in the colder months, further boosting revenues and profits.

In conclusion, FLEX LNG presents a compelling investment case for income investors seeking high and stable dividends, backed by the company's long-term charters and robust financial health.

FLEX LNG: 12% Yield, Tailwinds

FLEX LNG Ltd. (NYSE: FLNG) offers an attractive dividend yield of 12%, supported by long-term charters that provide stable earnings even during temporary market softness. The company’s fleet management strategy and favorable industry trends reinforce the security of the dividend.

The recent Q2 results showed revenues of $84.7 million, in line with guidance but reflecting seasonal softness. The company reported a net income of $21.8 million or $0.41 per share. Adjusted net income rose to $30.4 million or $0.56 per share after accounting for unrealized derivative losses.

The outlook for Q3 and Q4 looks promising, with revenues expected to rise to $90 million in Q3, driven by the return of all ships to full operation and improving market conditions. Historically, Q4 is FLNG’s strongest quarter due to increased seasonal demand for LNG.

FLNG has a massive charter backlog of 47 years, potentially growing to 66 years through extension options. This provides unparalleled earnings visibility and supports the 11.9% yield, making FLNG a bond-like investment. The company's strategic fleet management and long-term contracts position it well for consistent cash flow, even in volatile markets.

The shipping industry’s volatility, influenced by political events and currency risks, is mitigated by FLNG's use of derivatives to hedge risks. The company’s adjusted EPS, while not fully covering the $0.75 dividend in Q1-2 '24, shows strong dividend coverage when non-cash depreciation is considered.

Buying FLEX LNG ahead of potential rate cuts could be a smart move. Historically, high-yield equities like FLNG attract investors during rate cuts, potentially driving up demand and prices. With its tremendous yield and exceptional cash flow visibility, FLNG is a strong candidate as a fixed-income investment alternative.

FLEX LNG: A Bond-Like 11.9% Yield To Lock Before Rate Cuts

FLEX LNG Ltd., a company involved in the liquefied natural gas (LNG) shipping industry, has been benefiting from higher LNG prices and shipping rates following Russia's 2022 invasion of Ukraine. The company's fleet, consisting of modern LNG carriers, has secured long-term charters that provide stable earnings despite temporary market softness.

Key financial highlights include:

- Revenue was up 6.6% in 2023, but net income decreased by 36% due to increased interest expense and reduced gains on derivatives.

- Adjusted net income for 2023 was $137.3 million, with basic adjusted EPS of $2.56.

- The company has consistently paid a quarterly dividend of $0.75 since Q4 2021, with an additional three supplemental payouts. The forward dividend yield is at 12%.

- FLNG's adjusted EPS in Q1-2 2024 was $1.26, which, when adjusted for non-cash depreciation, suggests an EBITDA dividend payout ratio of 76.79%.

In terms of valuation, FLNG is trading at a trailing P/E of 11.73x, which is lower than the industry average of 15.64x. The forward P/E is at 10.49x, higher than the industry average of 7.35x. The company's stock price is 12% below the Wall Street analysts' average price target.

FLNG's financial performance has been stable, with EBITDA margins above industry averages. The company's leverage has decreased, but remains higher than the industry average. FLNG has a significant contract backlog, which provides cash flow stability and supports the dividend yield.

However, there are risks and challenges in the LNG shipping market, including potential volatility in spot rates and shifting demand patterns. Despite these challenges, FLNG's strategic fleet management and long-term charters position the company for steady earnings and a secure dividend.

The current market conditions and return of all ships to full operation in Q3 2024 are expected to improve revenues and profits, especially in Q4 when seasonal demand for LNG increases. FLNG's charter strategy and focus on long-term contracts are critical in maintaining stability and supporting the dividend yield, making it an attractive option for income-minded investors.

Flex LNG: Trade The Yield, Don't Marry It

FLEX LNG Ltd. is an LNG shipping company with a fleet of 13 carriers, offering a strong investment case for income-minded investors. The company boasts a high dividend yield of 11.9% to 12%, backed by long-term charters that provide stable earnings despite temporary market softness.

Key points include:

- Fleet and Contracts: FLNG's fleet is young, with an average age of 4.8 years, and has a significant contract backlog, including 47 years of minimum charter backlog with potential to grow to 66 years through extension options.

- Dividend Stability: The company has consistently paid a quarterly dividend of $0.75 per share, with a strong cash position and debt-free new fleet acquired at lower prices than current market rates, ensuring dividend stability.

- Financial Performance: Despite a 2.5% decrease in Q1 2024 revenues and a seasonal decline in Q2, FLNG's adjusted EPS and EBITDA margin remain stable and higher than industry averages.

- Valuations and Outlook: FLNG's valuation metrics, such as trailing and forward P/E, P/Sales, and EV/EBITDA, are premium compared to industry averages. The company's dividend yield is nearly twice that of its industry's average.

- Investment Case: With interest rate cuts potentially on the horizon, FLNG could be a compelling investment due to its bond-like characteristics and high yield, making it an attractive fixed-income investment alternative.

Overall, FLEX LNG presents a strong investment case for those seeking high-yield income investments, bolstered by its stable charter backlog and resilient earnings performance.